BTC update on 07.03.2025

Summary

BTC is still holding up in the short term, but dropping below key Fibonacci levels could create weakness. Long-term, a deeper correction isn’t mandatory, but it remains possible. The liquidation heatmap signals a potential move toward $85K, unless BTC manages to reclaim $92K quickly.

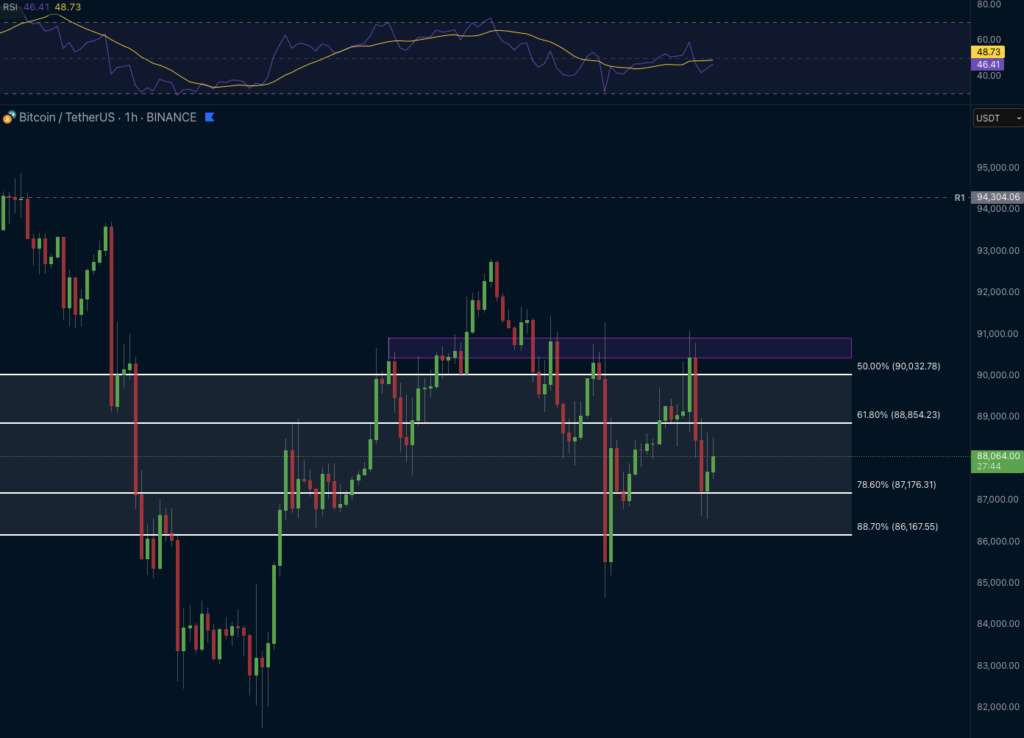

Short-term

As long as BTC continues pushing higher, the short-term outlook remains strong. However, if it drops below the 88.7% Fibonacci level, it could face short-term difficulties and lose momentum.

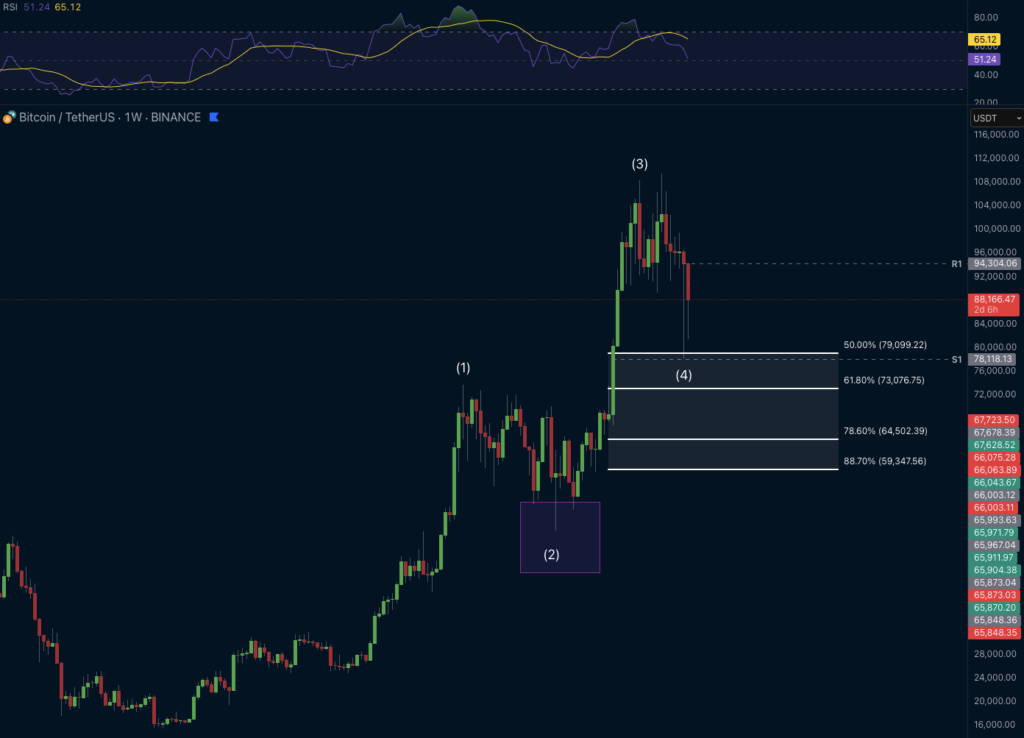

Long-term

There is still a possibility that BTC retests $79K, but it’s not a necessity. In the last two weeks, it has already come close to this level twice, suggesting buyers may have defended it well enough.

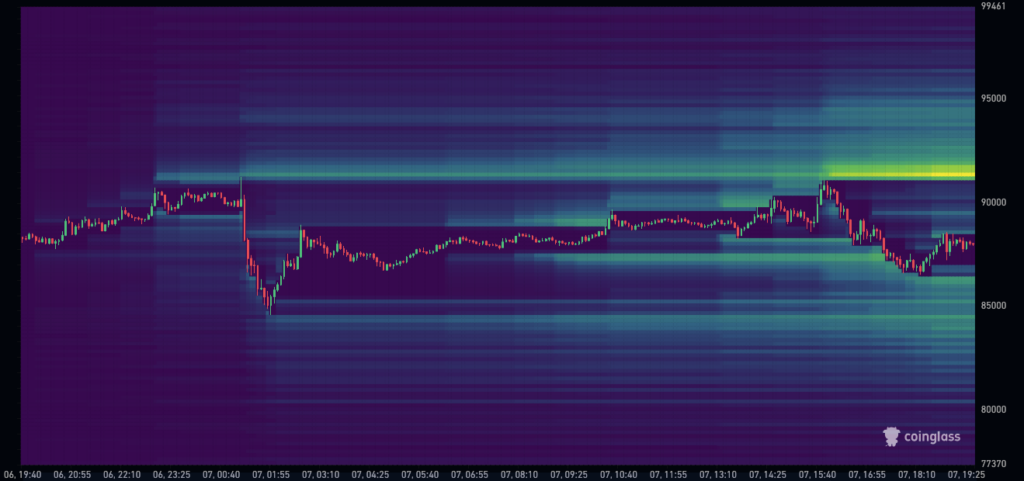

Liquidation Heatmap Analysis

The heatmap currently suggests a continuation of the downtrend in the short term, potentially toward $85K. However, for BTC to regain bullish momentum, it must break above $92K to shift sentiment and trigger liquidations higher up.