BTC update on 20.03.2025

Summary

BTC still looks solid in the short term, but $84K must hold—if it breaks, a fast drop to $75K becomes likely. Long-term, BTC is slowly grinding up, but the RSI suggests another potential low, which could lead to a reaction down to $67K before rebounding.

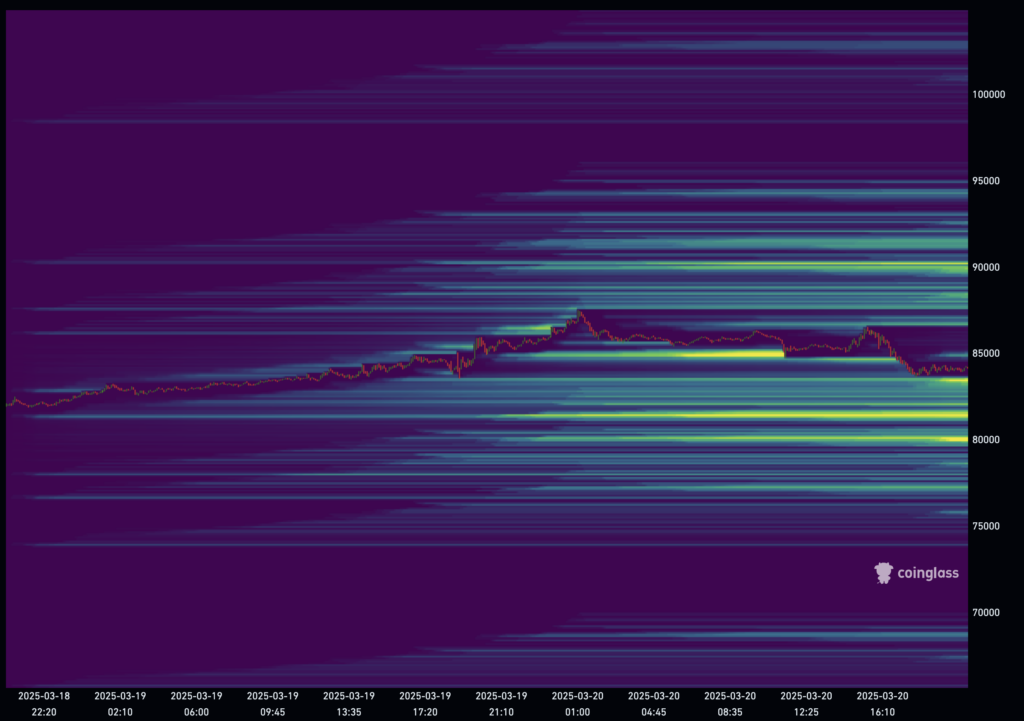

The liquidation heatmap remains neutral, with strong liquidity at $81K acting as support and growing interest at $84K–$85K. The real breakout zone sits at $92K, which, if breached, could trigger a strong rally. Until then, the market is in a consolidation phase, where both upside and downside liquidity are in play. Patience remains key.

Short-term

The short-term outlook remains strong, but $84K is the key level to hold. If it breaks below, a quick drop to $75K is likely. However, as long as support holds, the expectation remains for higher prices in the coming sessions.

Long-term

Price is gradually rising, but the RSI could still form another low, which might lead to a larger reaction down to $67K. If that happens, it would create a prime long-term buying opportunity before BTC continues higher.

Liquidation Heatmap Analysis

The liquidation data appears neutral, with no major imbalances at the moment. There’s solid liquidity at $81K, which has acted as support, and a growing cluster around $84K–$85K, showing interest in this zone. The strongest resistance ahead is still at $90K, where a breakout could trigger significant liquidations and push BTC much higher. If BTC fails to break up, a move down toward $75K would clear a lot of liquidity below before any major reversal. Patience is key, as the market is currently in a neutral accumulation phase.