BTC update on 23.04.2025

Summary

BTC followed the expected breakout path, offering profitable long opportunities. Now, it’s testing another critical resistance, and the weekend could decide whether BTC continues the rally or faces a short-term rejection.

Long-term structure still targets Wave 5, but after that, caution is advised. The market is in a key transitional phase—momentum is strong, but resistance zones must be respected.

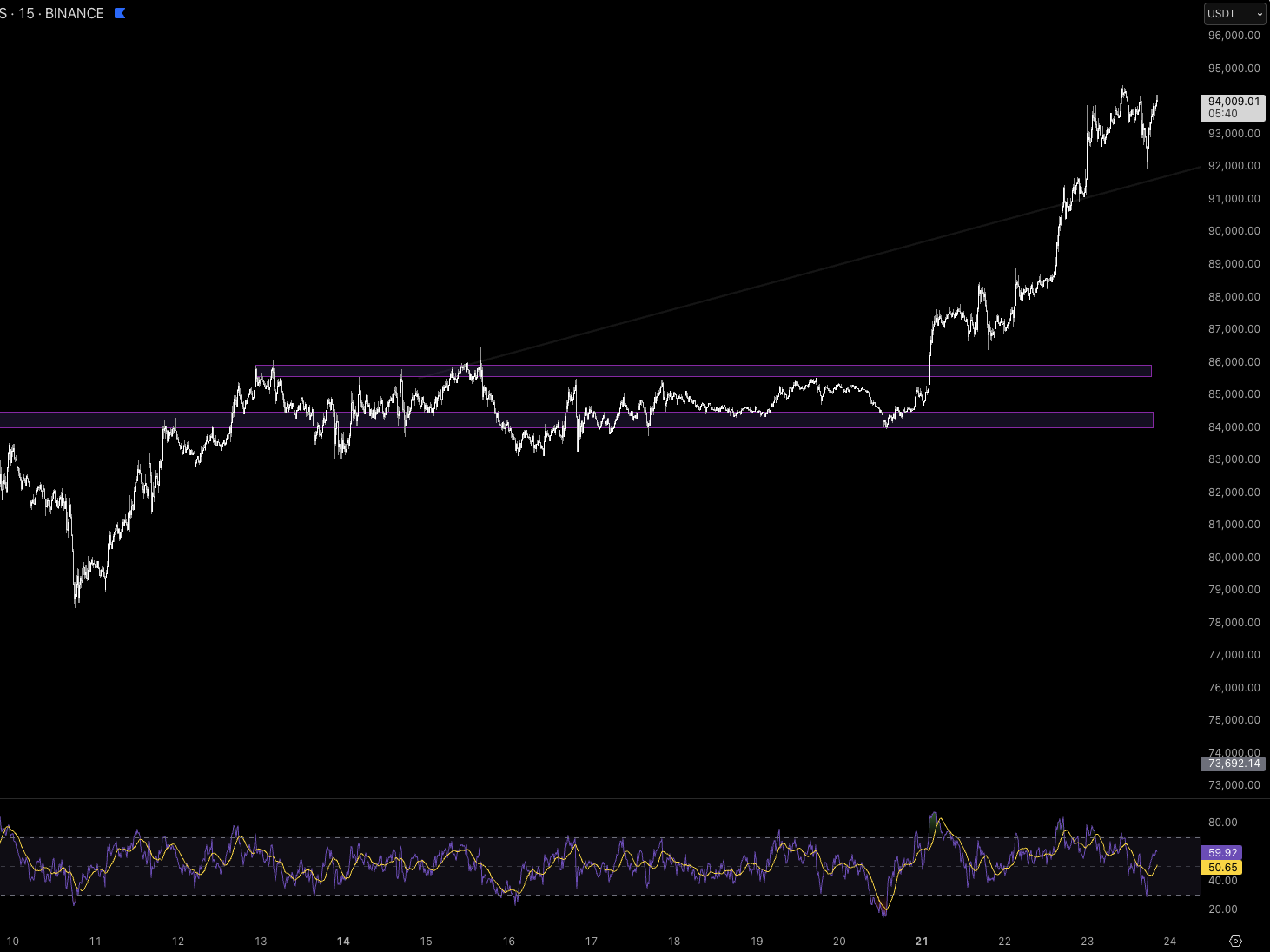

Short-Term (15min)

As previously mentioned, BTC broke out of the resistance zone and continued to climb. Had one followed the Astaria analysis and opened a long position after a confirmed breakout, it would now be deep in profit. How BTC performs next will become especially clear on the 4H chart, where momentum and structure develop more visibly.

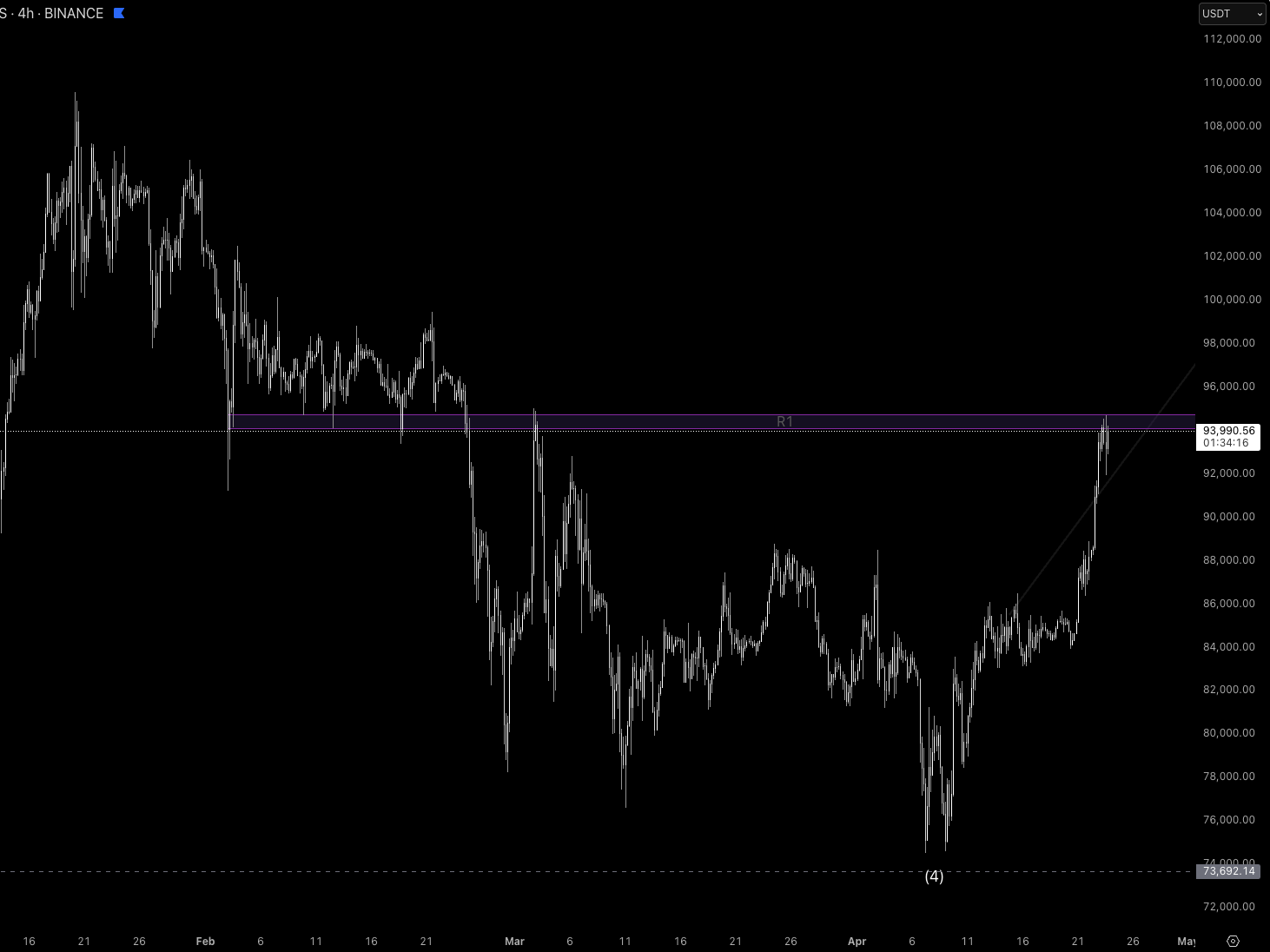

Mid-Term (4h)

BTC made a strong impulsive move upward, exactly as anticipated. However, it’s now facing a key resistance that it must break sustainably. If BTC fails to clear this zone, we expect a potential structural breakdown over the next 24–72 hours, especially through the weekend. Traders should now watch for possible short signals if rejection occurs.

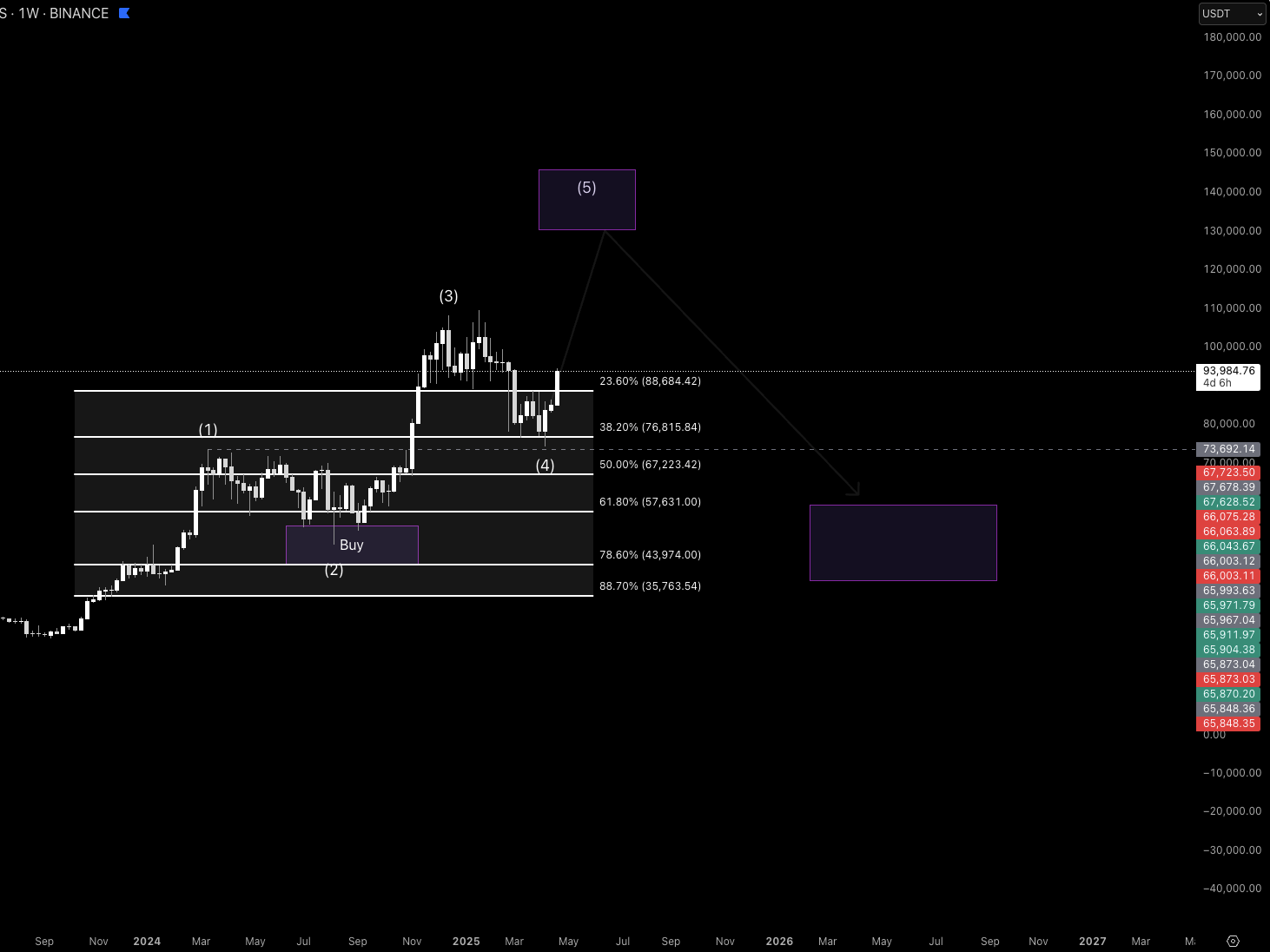

Long-Term (1w)

The pattern remains unchanged. BTC confirmed Wave 4 at the 38.2% retracement (slightly overshot), and is now on its way to complete Wave 5. Once this final wave is complete, a bearish reversal or larger correction could follow—marking the end of the current macro cycle.