BTC update on 24.03.2025

Summary

BTC is approaching the critical resistance zone at $90K–$92K. While it could break through, the more likely scenario is a pullback toward $65K, marking a potential Wave 4 correction. Both short- and long-term views align here. Liquidity data is neutral, but the rising volume hints at an upcoming strong move—the market is setting the stage, and the next few days will be key.

Short-term

Since the last update, there’s a slight shift in focus—it’s no longer about breaking $87K, but rather the $90K–$92K zone, which has formed a strong resistance cluster (violet zone). While BTC is currently pushing up, a sell-off is expected from this level. Of course, a direct breakout is possible, but it’s not the base case. If the correction plays out, Wave 4 could land around $65K. For now, there’s no confirmed target zone, and we let the structure unfold.

Long-term

Same as the short-term view—$90K–$92K needs to be cleared to regain full bullish momentum. Otherwise, we may see a healthy correction toward $65K as part of Wave 4, which would reset the structure and prepare for a stronger Wave 5.

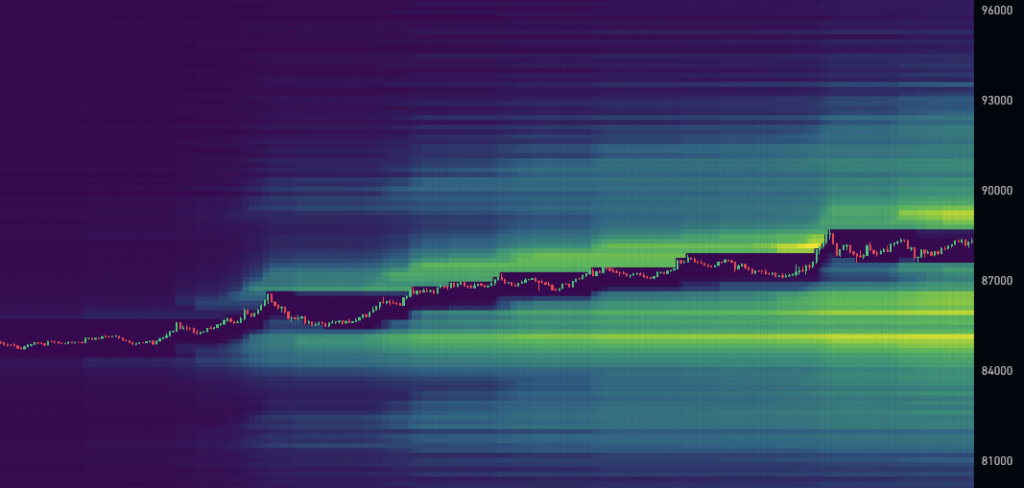

Liquidation Heatmap Analysis

The heatmap looks neutral, but it’s encouraging to see growing volume returning to the market. This suggests renewed interest and preparation for a bigger move—we just need to stay patient and watch for confirmation.