BTC is in a corrective phase, with S1 acting as the next key level to watch. If broken, S2 becomes fragile despite its importance. Long-term, $75K remains a valid buy zone if the trend continues downward. Liquidation data confirms the loss of a key level, and BTC now moves sideways near $82K, waiting for direction. Patience remains key in this phase.

BTC update on 29.03.2025

Summary

Short-term

BTC currently looks neutral, with the expected correction unfolding. The key now is to hold S1—if that level breaks, S2 likely won’t hold for long either. Still, S2 remains marked on the chart as a critical reference level. Interestingly, the RSI suggests that momentum could shift quickly, so short-term volatility should be watched closely.

Long-term

Still looking decent. BTC has a chance to reverse from here, but if not, a first accumulation zone around $75K will be defined, offering an opportunity to scale into long-term positions. The structure remains constructive as long as that level holds.

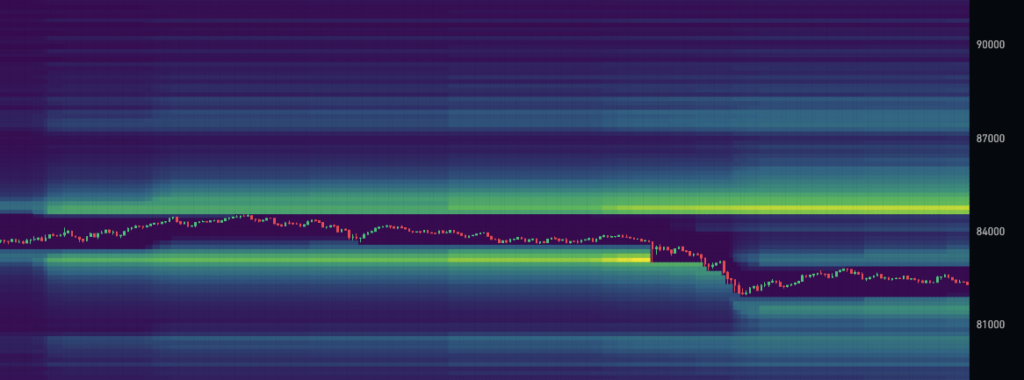

Liquidation Heatmap Analysis

The key level was broken, and BTC is now hovering around $82K, showing no clear strength just yet. It’s a wait-and-see zone, with the next big move likely to be reaction-based rather than trend-confirming.