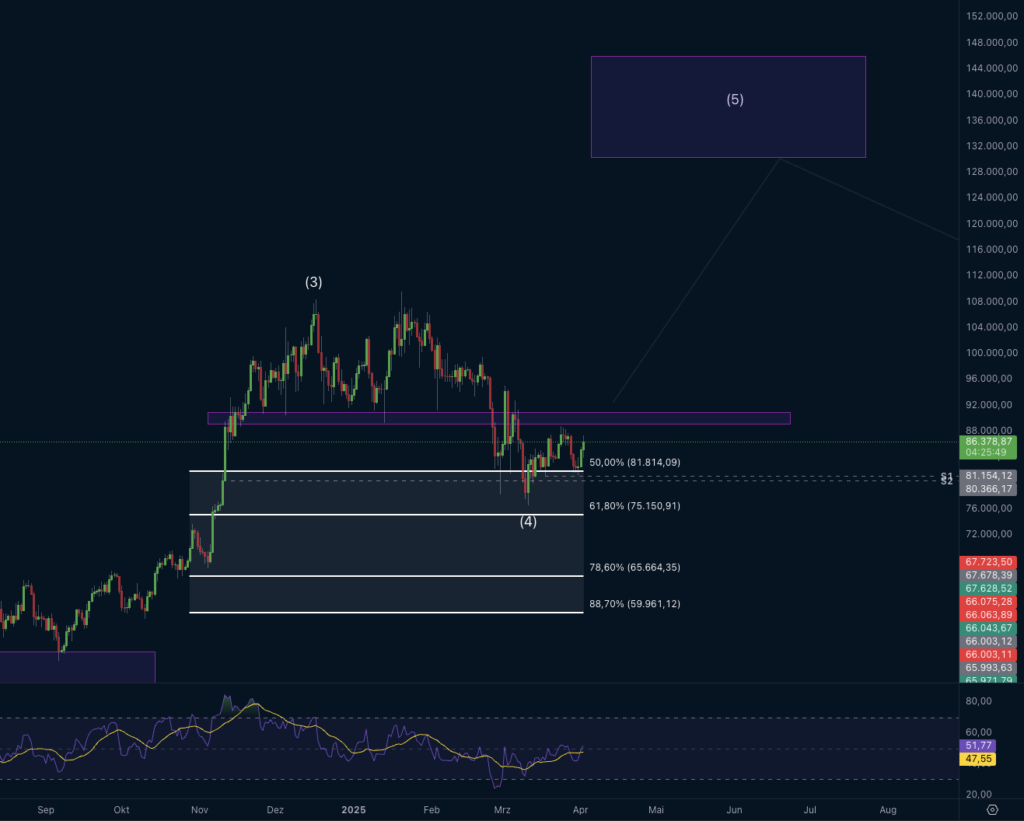

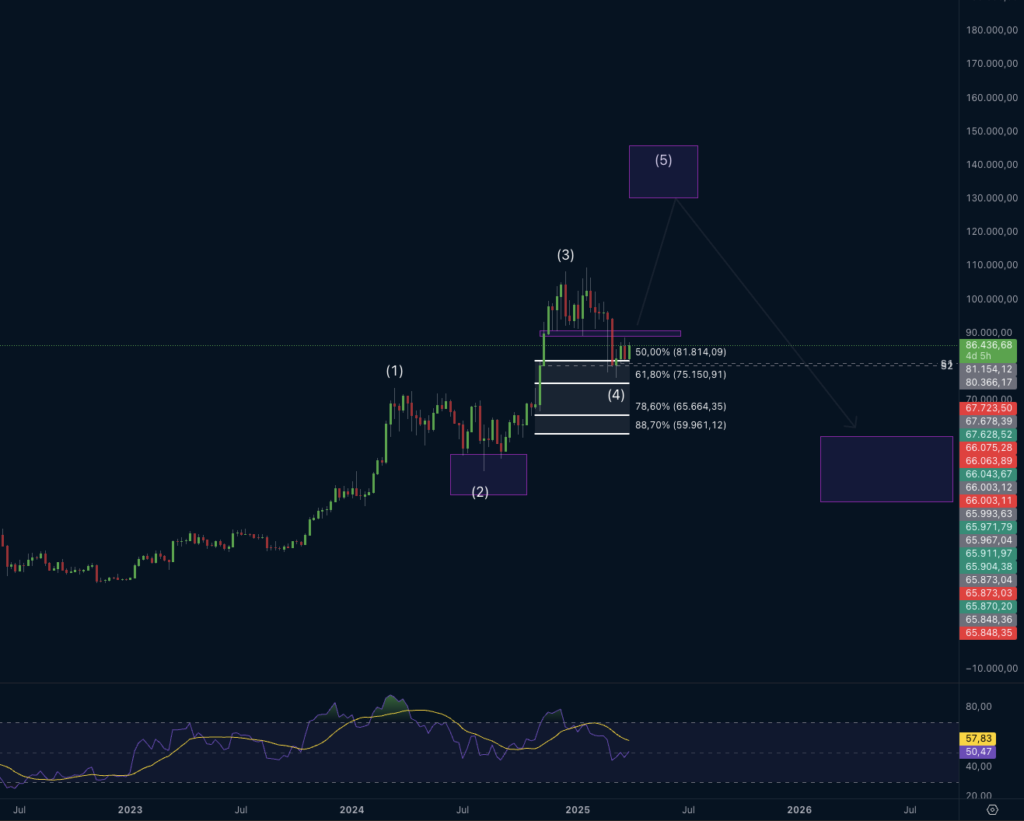

BTC looks technically strong across all timeframes. $91K–$92K remains the key breakout zone—if cleared and held, BTC could launch into a new leg higher, possibly toward $100K+.

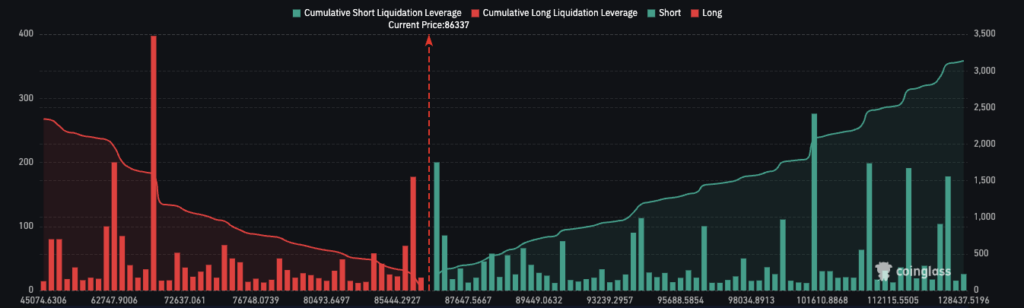

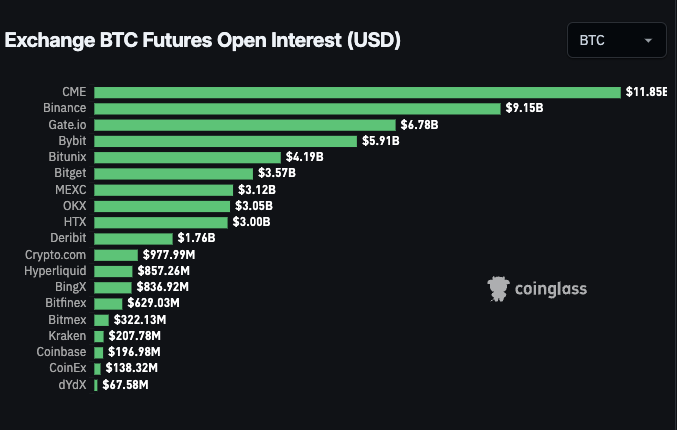

The liquidation map confirms room to run, with stacked shorts and little resistance above. Meanwhile, open interest signals a healthy, active market, not yet overheated.

📌 Momentum is building—the coming days could be decisive.